MOVING LOAN

Make the right move

with a moving loan through Smarter Credit

Make the right move with a moving loan through Smarter Credit

Check your rate and amount your eligible for with zero impact to your credit score in minutes*

One affordable fixed monthly payment

No prepayment penalty

Checking your rate is free & won't impact your credit score.*

A moving loan offers a solution to cover the costs of a cross-country move, truck rentals, storage, accommodations and other necessities.

Check your rate

See your rate and amount you’re eligible for risk free without any costs or impact to your credit.*

Choose your terms

Choose a fixed interest rate that stays the same offering peace of mind with one stable monthly payment.

Get funding fast

Get approvals in minutes and fast funding. Choose flexible terms from 12 to 60 months.

No prepayments fee or penalty

Pay off your moving loan loan anytime without prepayment fees or penalty.

You can apply for a moving loan quickly and easy in just minutes

1

Choose your loan amount

Choose a loan amount up to $ 100,000.

2

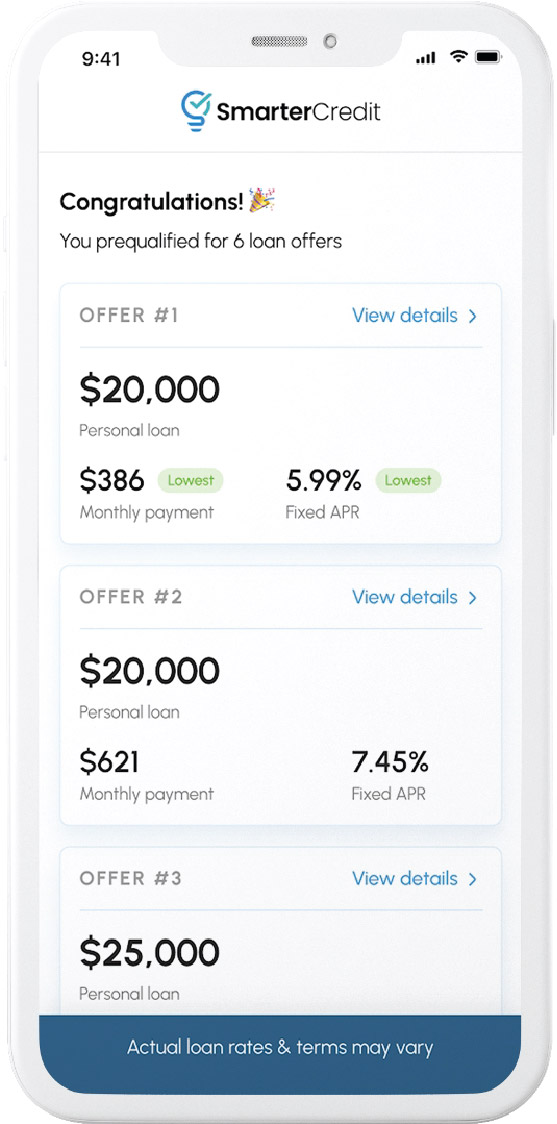

Get your offers in minutes

In just minutes, apply and check your rate with no string attached, no cost, and no impact on your credit score.*

3

Choose your loan terms & funds

Receive multiple loan options and choose the offer that best fits your budget for your move.

Receive multiple major moving loan options

Choose the offer that best fits your budget for your move

One fixed monthly payment

Choose an offer that best fits your budget for your move.

Pay over time in installments

Pay off anytime without prepayment fees or penalty.

Moving loan FAQs

What is a moving loan?

A moving loan, often referred to as a relocation loan, is a form of personal loan designed to cover moving expenses. Typically, these loans are unsecured, meaning you don’t need to provide collateral to secure them.

What can I use a moving loan for?

Your moving loan can be used to cover a wide range of relocation expenses, including hiring professional movers, settling security deposits, acquiring moving insurance, and taking care of unexpected moving costs.

How much can I borrow with a moving loan?

We offer personal loans with a maximum limit of $100,000, with the specific amount you’re eligible to borrow being determined by your application details and qualifications.

Can I use a credit card for my moving expenses?

Yes, credit cards can be used, but they are a form of revolving credit that can potentially lead to overspending and accumulating high-interest debt. They can be a viable option if you are able to pay the full balance monthly. Alternatively, consider a moving loan which offers more predictability with a fixed interest rate and one monthly payment.

What are the benefits of getting a moving loan?

Benefits include:

– Fast and easy approval process

– No prepayment penalty

– Fixed interest rates

– One monthly payment

Make the right move with a moving loan through Smarter Credit

Checking your rate is free and won’t affect your credit score*