CREDIT CARD REFINANCE

Consolidate your credit card balances with a personal loan

Credit card consolidation loan up to $100,000

Refinance high interest rate credit card debt with a lower rate loan

One fixed affordable monthly payment

Checking your rate is free & won't impact your credit score.*

Why should you consider refinancing your credit cards with a personal loan?

One payment

Combine multiple debts into a single payment that can be easily managed and paid off.

Eliminate high-interest

Replace your high interest debt and credit card payments with a more manageable, lower rate.

Fixed rate

Choose a fixed interest rate that stays the same offering peace of mind with one stable monthly payment.

A faster way

With credit card consolidation loan, you’ll have a definitely payoff date you can mark on your calendar.

You can apply for a credit card consolidation loan quickly and easily in just minutes

1

Choose your loan amount

Choose a loan amount up to $100,000.

2

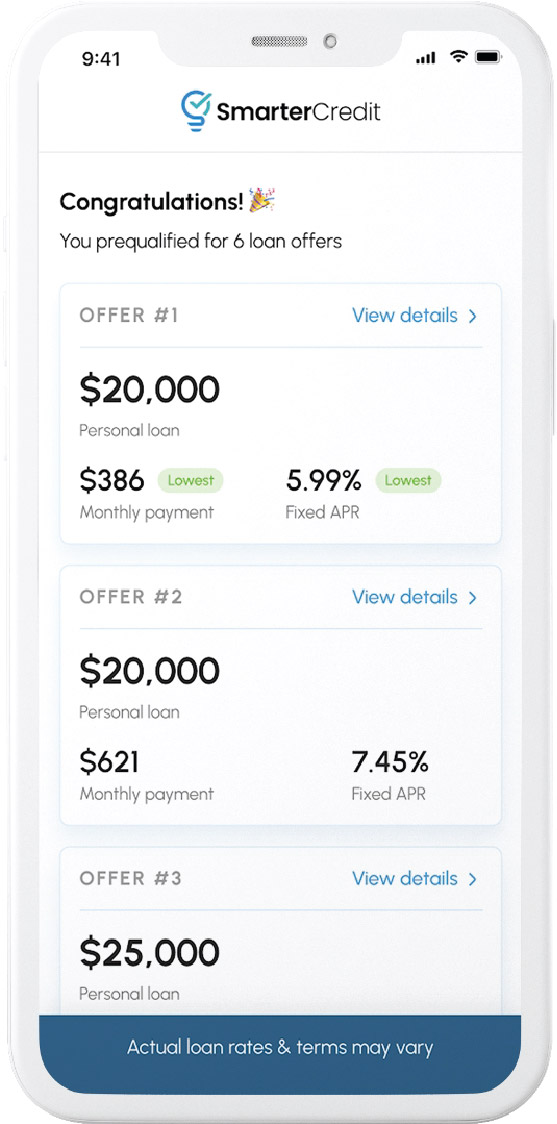

Get your offers in minutes

In just minutes, apply and check your rate with no string attached, no cost, and no impact on your credit score.*

3

Choose your loan terms & funds

Receive multiple loan options and choose the offer that best fits your credit card consolidation goals.

Receive multiple loan options from Smarter Credit

Choose the offer that best fits your budget and credit card consolidation goals.

One fixed monthly payment

Choose an offer that best fits your budget and credit card refinance goals.

A faster way out of debt

Replace high-interest credit card payments with a more manageable lower rate.

Credit card consolidation loan FAQs

How does credit card refinancing work?

How does refinancing credit card debt with a personal loan differ from a balance transfer?

A balance transfer involves moving debt from one account to another, potentially lowering your interest rate. However, there are drawbacks, including typically a balance transfer has a fee on the transferred amount. Your balance transfer card may have a low limit, preventing you from moving the full balance. Transferring a balance from the same issuer is usually not allowed. Additionally, since you’re moving debt from one credit card to another, you may encounter variable interest rates that could cost more over time. On the other hand, a personal loan offers a fixed interest rate and a predetermined debt-free date.

How much credit card debt can I consolidate with a loan through Smarter Credit?

We offer personal loans with a maximum limit of $100,000, with the specific amount you’re eligible to borrow being determined by your application details and qualifications.

What are my options if I want to repay my loan ahead of schedule?

No need to worry, if you’re able to repay your loan ahead of the scheduled final payment, that’s wonderful news. You won’t face any penalties or fees for early repayment.

Replace high interest rate credit card payments with a more manageable lower rate through Smarter Credit

Checking your rate is free and won’t affect your credit score*