MAJOR PURCHASE

Make that large purchase

with a major purchase loan up to $100,000

Make that large purchase with a major purchase loan up to $100,000

Check your rate and amount your eligible for with zero impact to your credit score in minutes*

One affordable fixed monthly payment

No prepayment penalty

Checking your rate is free & won't impact your credit score.*

Why choose a major purchase personal loan for your large purchases?

Check your rate

See your rate and amount you’re eligible for risk free without any costs or impact to your credit.*

Choose your terms

Choose a fixed interest rate that stays the same offering peace of mind with one stable monthly payment.

Get funding fast

Get approvals in minutes and fast funding. Choose flexible terms from 12 to 60 months.

No prepayments fee or penalty

Pay off your major purchase loan anytime without prepayment fees or penalty.

You can apply for a purchase loan quickly and easy in just minutes

1

Choose your loan amount

Choose a loan amount up to $ 100,000.

2

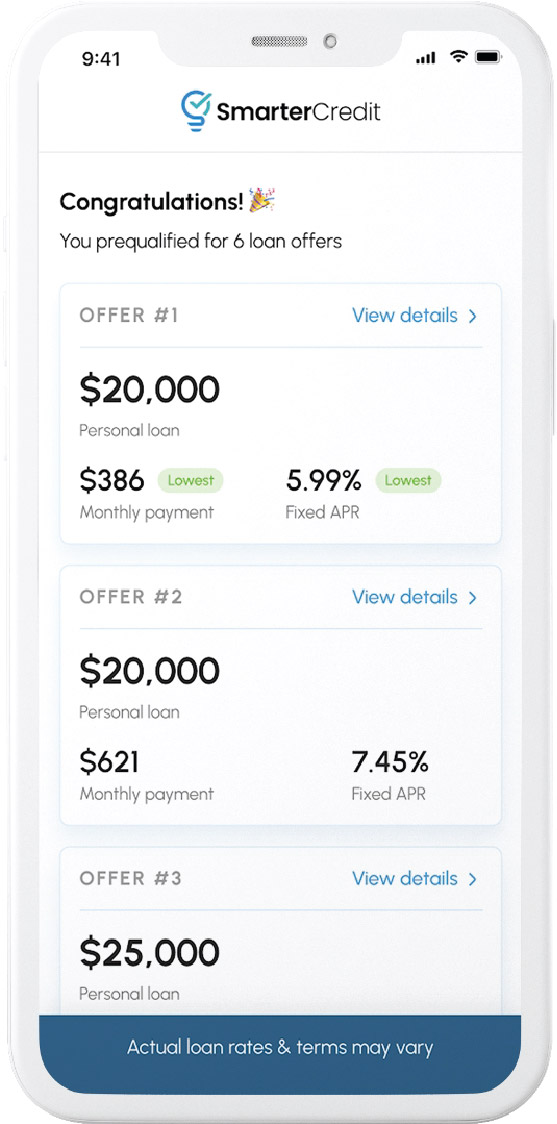

Get your offers in minutes

In just minutes, apply and check your rate with no string attached, no cost, and no impact on your credit score.*

3

Choose your loan terms & funds

Receive multiple loan options and choose the offer that best fits your large purchase goals.

Receive multiple major purchase loan options

Choose the offer that best fits your budget and large purchase goals

One fixed monthly payment

Choose an offer that best fits your budget for your major purchase.

Pay over time in installments

Pay off anytime without prepayment fees or penalty.

Major purchase loan FAQs

Why should you consider options other than a credit card for a major purchase?

Credit cards often come with variable interest rates that can increase at any time, making it difficult to anticipate the actual cost of a major purchase or its payoff date. Opt for a personal loan through Smarter Credit instead, where you’ll enjoy a low fixed interest rate and stable monthly payments. This way, you’ll know exactly how much you’ll be paying each month and when you’ll be fully paid off.

How much can I borrow with a major purchase loan?

We offer personal loans with a maximum limit of $100,000, with the specific amount you’re eligible to borrow being determined by your application details and qualifications.

Will my credit score be affected if I check my rate?

Checking your rate with us will not impact your credit score. We conduct a soft inquiry on your credit report, visible only to you, to determine the offers for which you may qualify. When you accept an offer and your loan is funded, a hard credit inquiry will be performed, which could influence your credit score and can be viewed by third parties.

What are my options if I want to repay my loan ahead of schedule?

No need to worry, if you’re able to repay your loan ahead of the scheduled final payment, that’s wonderful news. You won’t face any penalties or fees for early repayment.

Make that major purchase with terms that fit your budget and pay over time in installments

Checking your rate is free and won’t affect your credit score*